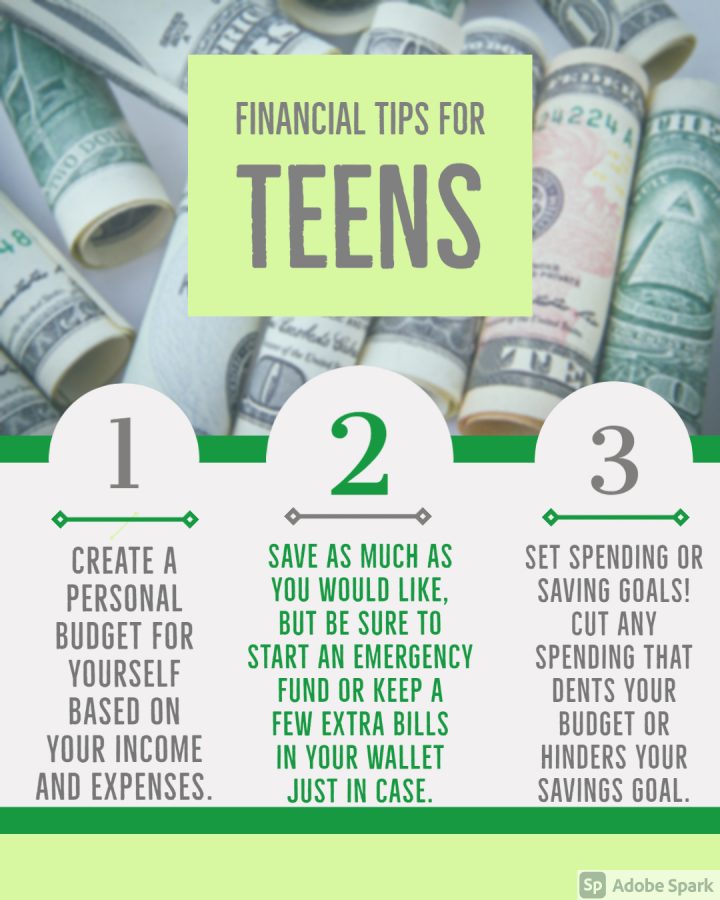

2020 has been over for more than a week. Instead of jumping over the hurdle in an effortless leap, we crawled under it in an awkward tangle of limbs and bruises. But reflecting on the bad times can push us to make better habits. A useful habit I’d like to expand on is financial planning, now that the holiday rush is over.

Nearly half of teenagers in the U. S. were laid off due to COVID-19, and thousands of adults were forced to either find new jobs or work from their homes. So this year, especially as midterms approach (with an amplified inclination to spend on caffeine), I encourage my fellow working students to make their own budgets and/or set financial goals.

There are plenty of resources for students to keep track of their money and set budget goals. One of the most popular budget apps for teens is the Mint app, and the next best is Goodbudget. Both apps are very helpful and have great reviews.

On the less technological side, there are a plethora of planners from Amazon. Chain stores like Barnes & Noble, Staples, Target, The Paper Store, or even Walmart sell planners at decent prices. Erin Condren, an online website that sells personalized planners, is fun to explore as well. There are many different ways to organize your money with all of these resources.

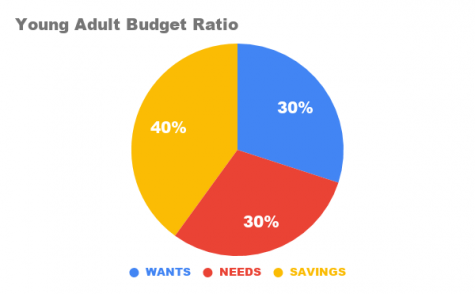

According to an extremely useful article from “Teen Financial Freedom,” high school students typically don’t need to put half of their paychecks toward bills. Instead, the 40:30:30 ratio is introduced. This way, the average paycheck is split into three simple categories: savings, wants, and needs. A summary of expenses for each of these three categories is listed below.

Savings (40% of budget)

- Savings Account(s)

- Emergency Fund

- College Savings

Needs (30% of budget)

- Insurance

- Car repairs

- Gas

- Cell phone

- Subscriptions

Wants (30% of budget)

- Fast food, coffee, etc.

- Clothing

- Online shopping

I myself am going to try this method throughout 2021 and hope you will too, even if it’s jotting some numbers down on a piece of paper. I know it can be difficult to refrain from the “add to cart” button, but it will pay off in the long run. Any kind of goal or fixed budget will propel us, as young adults, to develop good financial routines before graduating high school.